OZ 2.0 Enacted!

House Bill Would Result In 22% Fewer Opportunity Zones

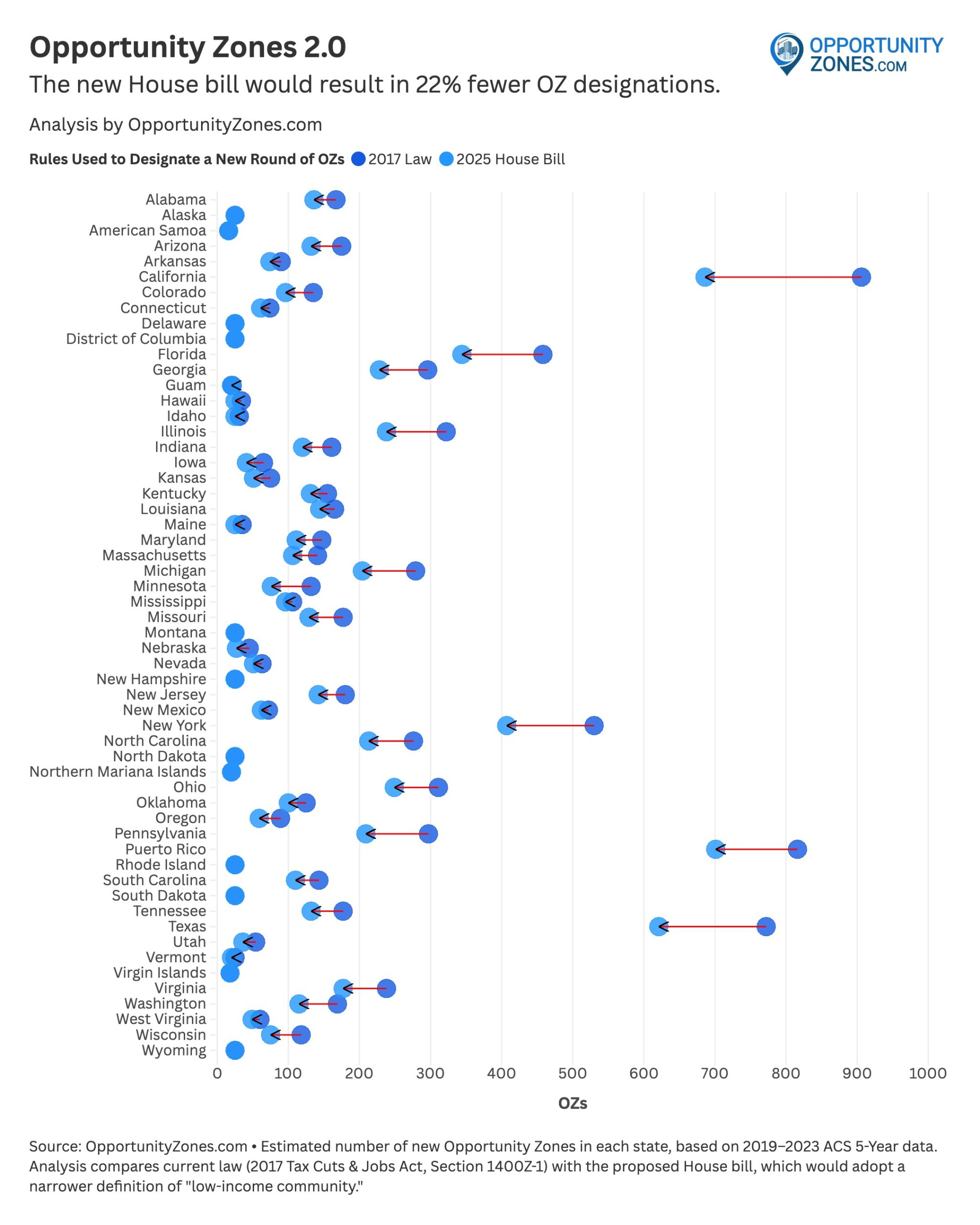

The newly proposed House reconciliation bill would introduce a new round of Opportunity Zone designations, but would significantly narrow the pool of OZ-eligible census tracts. If enacted, the legislation would result in 22% fewer Opportunity Zones nationwide in the new “OZ 2.0” round, according to our new analysis of 2019–2023 American Community Survey (ACS) data.

Update: Jimmy will go LIVE on YouTube on May 21 at 3:00 p.m. Eastern Time to discuss:

Two Sets of Rules, Two Different Maps

Our analysis compares a new round of Opportunity Zone designations under two scenarios:

- Current Law: The rules established by the 2017 Tax Cuts & Jobs Act (Section 1400Z-1), which have governed the program since its inception.

- Proposed House Bill: The new criteria outlined in the recently released House reconciliation bill, which would tighten the definition of “low-income community” for the purposes of designating a new round of Opportunity Zones.

Here are the findings of our analysis of the new “OZ 2.0” round, using 2019-2023 ACS 5-Year data (the most recent available).

Under Current Law:

- 33,750 census tracts meet the eligibility criteria for OZ designation nationwide.

- 9,186 tracts would be designated as Opportunity Zones. The increase from the current number of OZs (8,764) is due mostly to population increases that have resulted in a larger number of census tracts nationwide.

Under the New House Bill:

- The pool of eligible tracts drops to 25,630.

- Only 7,133 tracts would be designated as Opportunity Zones—22% fewer zones, a loss of over 2,000 zones.

State-by-State Impact

Most states would see a reduction in both eligible tracts and designated Opportunity Zones, though the extent of the impact varies. The largest reductions occur in states with substantial urban populations and higher baseline counts of OZ-eligible tracts.

The table below lays out how the House bill would impact the number of Opportunity Zones in a new round of designations. Three counts for each state are considered: the current number of OZs, the number of OZs in a new round of designations using existing 2017 law, and the number of OZs in a new round of designations using new eligibility criteria as proposed in the House bill.

| Jurisdiction | Current OZs (2018 Map) | OZ 2.0 Designations (2017 Law) | OZ 2.0 Designations (2025 House Bill) | 2025 House Bill vs. 2017 Law |

|---|---|---|---|---|

| Alabama | 158 | 167 | 136 | -19% |

| Alaska | 25 | 25 | 25 | 0% |

| American Samoa | 16 | 16 | 16 | 0% |

| Arizona | 168 | 175 | 132 | -25% |

| Arkansas | 85 | 90 | 74 | -18% |

| California | 879 | 906 | 686 | -24% |

| Colorado | 126 | 135 | 96 | -29% |

| Connecticut | 72 | 74 | 61 | -18% |

| Delaware | 25 | 25 | 25 | 0% |

| District of Columbia | 25 | 25 | 25 | 0% |

| Florida | 427 | 458 | 344 | -25% |

| Georgia | 260 | 296 | 228 | -23% |

| Guam | 25 | 21 | 20 | -5% |

| Hawaii | 25 | 34 | 25 | -26% |

| Idaho | 28 | 31 | 25 | -19% |

| Illinois | 327 | 322 | 238 | -26% |

| Indiana | 156 | 161 | 120 | -25% |

| Iowa | 62 | 65 | 41 | -37% |

| Kansas | 74 | 75 | 51 | -32% |

| Kentucky | 144 | 155 | 131 | -15% |

| Louisiana | 150 | 165 | 144 | -13% |

| Maine | 32 | 35 | 25 | -29% |

| Maryland | 149 | 147 | 111 | -24% |

| Massachusetts | 138 | 141 | 106 | -25% |

| Michigan | 288 | 279 | 204 | -27% |

| Minnesota | 128 | 132 | 76 | -42% |

| Mississippi | 100 | 106 | 96 | -9% |

| Missouri | 161 | 177 | 129 | -27% |

| Montana | 25 | 25 | 25 | 0% |

| Nebraska | 44 | 45 | 27 | -40% |

| Nevada | 61 | 63 | 51 | -19% |

| New Hampshire | 27 | 25 | 25 | 0% |

| New Jersey | 169 | 180 | 142 | -21% |

| New Mexico | 63 | 72 | 62 | -14% |

| New York | 514 | 530 | 407 | -23% |

| North Carolina | 252 | 276 | 213 | -23% |

| North Dakota | 25 | 25 | 25 | 0% |

| Northern Mariana Islands | 20 | 20 | 20 | 0% |

| Ohio | 320 | 311 | 249 | -20% |

| Oklahoma | 117 | 125 | 100 | -20% |

| Oregon | 86 | 89 | 59 | -34% |

| Pennsylvania | 300 | 297 | 209 | -30% |

| Puerto Rico | 863 | 816 | 701 | -14% |

| Rhode Island | 25 | 25 | 25 | 0% |

| South Carolina | 135 | 143 | 110 | -23% |

| South Dakota | 25 | 25 | 25 | 0% |

| Tennessee | 176 | 177 | 132 | -25% |

| Texas | 628 | 772 | 621 | -20% |

| Utah | 46 | 54 | 36 | -33% |

| Vermont | 25 | 25 | 20 | -20% |

| Virgin Islands | 14 | 18 | 18 | 0% |

| Virginia | 212 | 238 | 177 | -26% |

| Washington | 139 | 169 | 115 | -32% |

| West Virginia | 55 | 60 | 49 | -18% |

| Wisconsin | 120 | 118 | 75 | -36% |

| Wyoming | 25 | 25 | 25 | 0% |

| Nationwide | 8,764 | 9,186 | 7,133 | -22% |

Why the Change?

Opportunity Zones were created to attract long-term private investment to distressed areas by providing capital gains tax incentives for qualified investments. However, critics have argued that the eligibility rules allowed too many tracts—including some that have already experienced significant economic growth—to qualify. The proposed reforms seek to address these concerns by tightening the eligibility standards and focusing the program more narrowly on genuinely distressed communities.

Key Findings

- Total number of low-income OZ-eligible tracts would drop by 24%.

- The reduction in the number of OZ-eligible tracts would result in 22% fewer zones nationally.

- The reduction in zones could alter the geographic focus of OZ investments and reshape the landscape for community development efforts.

Policy Recommendations: Strengthening Opportunity Zones by Broadening Access

While the intent behind tightening Opportunity Zone (OZ) eligibility is to better focus incentives on deeply distressed areas, overly restrictive definitions risk leaving behind communities that could benefit from investment, but fall just short of arbitrary cutoffs. Eliminating contiguous non-low income tracts (as the House bill proposes) is already a big step in the right direction.

But overall, based on this analysis, a more balanced approach is warranted—one that keeps the program’s integrity, expands economic opportunity, and maintains the total number of Opportunity Zones nationwide at roughly current levels.

Recommended Reforms

- Set the income threshold at 75% of area/state median family income: Rather than adopting the proposed 70% threshold for median family income, a 75% AMFI standard would strike a more reasonable balance. This would ensure that neighborhoods with real economic need—but not the most extreme distress—remain eligible for OZ designation. Many such communities are at risk of stagnation or decline, and private capital can still have a catalytic impact.

- Raise the statutory designation cap to 30%: The original OZ framework allowed each state to designate up to 25% of eligible tracts as Opportunity Zones. Increasing this cap to 30% would provide states and communities with greater flexibility to target investment to both the neediest and the most promising areas for revitalization. This is particularly important in states with large rural populations, legacy industrial areas, or regions facing persistent disinvestment.

Rationale

A less restrictive approach to defining “low-income community” would help ensure that the Opportunity Zone program remains a tool for inclusive economic development, rather than one that narrowly targets only the very poorest census tracts. Many middle-tier communities—those that are struggling but not in crisis—have the potential to thrive with targeted private investment. A more flexible designation framework can foster job creation, expand the tax base, and help address broader regional disparities.

By only modestly tightening eligibility, Congress can ensure that the next generation of Opportunity Zones reaches more communities that need it—without diluting the program’s core mission.

What’s Next?

The House reconciliation bill is still under consideration, and further amendments are not only possible, but likely—especially once the bill moves to the Senate. If enacted, the reforms would represent the most significant change to Opportunity Zone eligibility since the program’s creation, with meaningful implications for investors, communities, and policymakers.

Methodology

This analysis estimates the number of census tracts eligible for Opportunity Zone (OZ) designation—and the number that would ultimately be designated—under both current law and the proposed House bill, using the most recent demographic data.

Data Sources

- 2019–2023 American Community Survey (ACS) 5-Year Estimates from the U.S. Census Bureau provided tract-level data on poverty rates and median family income.

- OMB Metropolitan Statistical Area (MSA) delineation files were used to distinguish between metropolitan and non-metropolitan tracts and to calculate relevant area median incomes.

- 2020 Decennial Census of Island Areas (DECIA) data was used to determine tract eligibility for American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. The DECIA is a specialized component of the decennial census program conducted every ten years to provide demographic and economic information for these U.S. territories.

Eligibility Calculations

For both current law (as established by the Tax Cuts & Jobs Act of 2017) and the proposed House bill, census tracts were evaluated for OZ eligibility as follows:

The current law states: Tracts qualify if they meet one of the following two tests:

- The poverty rate of the tract is at least 20%; or

- For non-metropolitan tracts, the median family income for the tract does not exceed 70% of statewide median family income, or for metropolitan tracts, the median family income for the tract does not exceed 80 percent of the greater of statewide median family income or the metropolitan area median family income.

The proposed House bill states: Tracts qualify if they meet one of the following two tests:

- The poverty rate of the tract is at least 20%, and median family income is below 125% of statewide median family income in for non-metropolitan tracts (or below 125% of area median family income for metropolitan tracts); or

- For non-metropolitan tracts, the median family income for the tract does not exceed 70% of statewide median family income, or for metropolitan tracts, the median family income for the tract does not exceed 70% of the greater of statewide median family income or the metropolitan area median family income.

For Island Areas, eligibility thresholds were applied in a manner consistent with the available DECIA data.

For both rule sets, a statutory cap limits the number of designated Opportunity Zones to no more than 25% of eligible tracts in each jurisdiction. States with fewer than 100 eligible tracts are able to designate 25 Opportunity Zones. States with fewer than 25 eligible tracts are able to designate all of their eligible tracts as Opportunity Zones. Puerto Rico has a special rule whereby they are able to designate all of their eligible tracts as OZs.

Contiguous Non-Low Income Tracts

The new House bill would eliminate the ability for states to designate any contiguous non-low income tracts. Our analysis does not include these tracts that could potentially qualify for Opportunity Zone designation solely by being contiguous to other eligible low-income tracts (i.e., those that do not meet the low-income criteria themselves but are adjacent to qualifying tracts and meet certain additional requirements under current law).

Including these tracts in our analysis for the purposes of calculating the total number of eligible OZ 2.0 tracts under the 2017 law would not meaningfully affect national or state-level totals in this analysis. Therefore, for clarity and consistency, all results are based strictly on tracts meeting the primary low-income eligibility tests under each rule set.

Analytical Approach

- Calculations were performed in Google Sheets, including poverty rate computation, income threshold checks, and state/MSA mapping.

- Each tract was classified by eligibility under both rule sets.

- The 25% cap rule was applied to each state to estimate the number of designated OZs under both scenarios.

Limitations

- Analysis is based on the most recent ACS 5-Year and DECIA data available at the time of study.

- Actual designated tracts may vary based on state selection priorities and other administrative factors not modeled here.