OZ Pitch Day On-Demand

Opportunity Zone Asset Class Reaches Estimated $150 Billion

Through year-end 2023, an estimated $150 billion in equity has been raised by Qualified Opportunity Funds since program inception in 2018. QOFs are tax-advantaged investment funds through which Opportunity Zone projects receive funding.

By this aggregate measure, Opportunity Zones have been a huge success, shattering even the most optimistic projections when the program was first rolled out in 2018.

Novogradac Data, Extrapolated

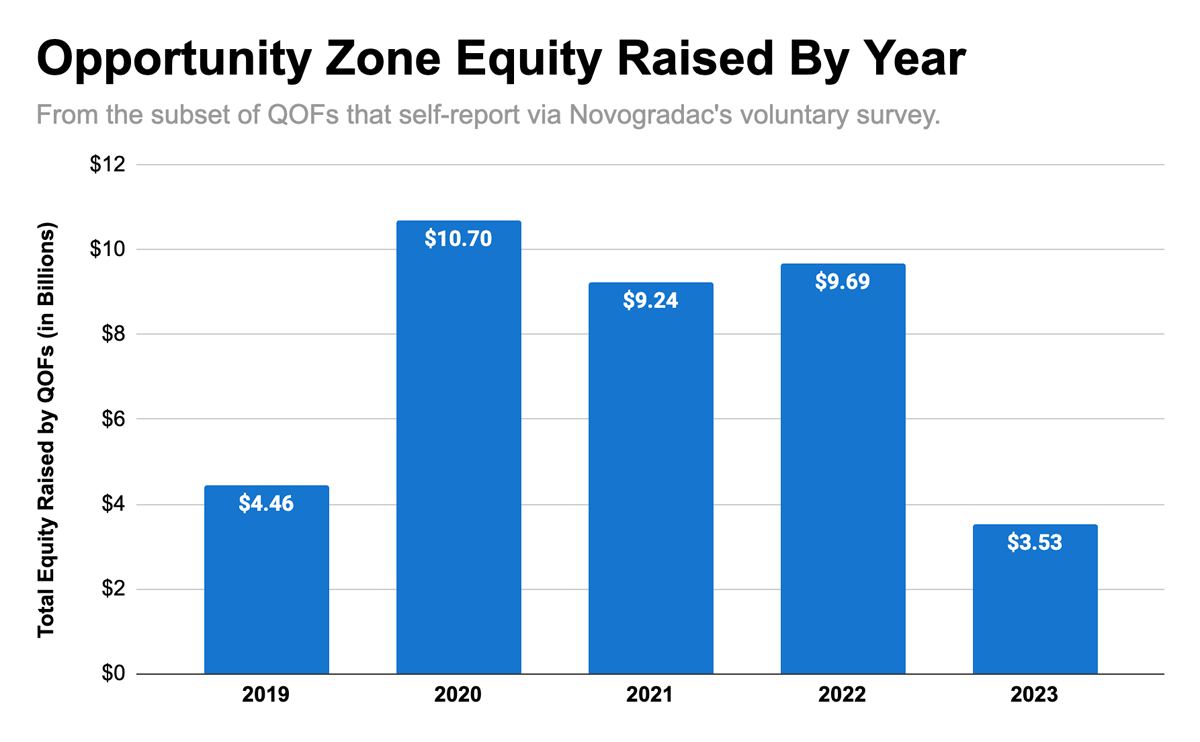

Now, the bad news: Qualified Opportunity Funds tracked by Novogradac raised just $3.53 billion in equity last year, making 2023 the slowest year of fundraising in the short history of the OZ program.

As of December 31, 2023, Qualified Opportunity Funds participating in Novogradac’s voluntary survey of the industry have reported a total of $37.62 billion in equity raised since program inception in 2018.

Of note, Novogradac’s survey is not comprehensive. Because Novogradac is only able to survey a portion of the total QOF universe that self reports directly to Novogradac or reports to the SEC, the $37.62 billion in equity raised by QOFs through the end of 2023 is only a fraction of the total amount of equity raised by all Opportunity Zone funds.

Novogradac estimates that the actual total is likely three to four times greater that what gets captured in their survey reporting, which would put the total amount of QOF equity raised for Opportunity Zones since program inception in the range of roughly $112 billion to $150 billion.

2023: A Slow Year For Opportunity Zones & Other Asset Classes

Overall, Opportunity Zone fundraising in 2023 was down 64 percent from the prior year. And the $410 million raised in 2023 Q4 represents the smallest level of QOF fundraising in any period since Novogradac began reporting OZ fundraising data in 2019.

But the slowdown in 2023 was by no means limited to Opportunity Zones. Negative investor sentiment coupled with rapidly rising interest rates resulted in a widespread drop in transaction volume across a variety of asset classes.

According to CBRE, U.S. commercial real estate investment volume fell by 52 percent year over year. According to S&P Global Market Intelligence, total M&A transaction volume fell 32 percent year over year. And according to Robert A. Stanger & Company, non-traded alternative investment fundraising fell 30 percent year over year.

2024: Reason For Optimism?

With the S&P 500 hitting new record highs recently — the broad stock market index was up 24 percent in 2023 — and with the prospect of lower interest rates coming at some point in 2024, there is reason to be optimistic about a possible resurgence in Opportunity Zone fundraising in 2024 and 2025.

Additionally, the prospect of bipartisan OZ reform legislation at some point either this year or next may also provide a tailwind for additional QOF fundraising growth in the future.

Novogradac QOF Survey Reporting History

| Reporting Period End Date | Total Funds Raised (Billions) | Number Of QOFs Reporting Funds Raised | Funds Raised During Period (Billions) |

|---|---|---|---|

| 6/28/2019 | $0.79 | 28 | $0.79 |

| 9/20/2019 | $2.50 | 57 | $1.71 |

| 10/24/2019 | $3.17 | 112 | $0.67 |

| 12/9/2019 | $4.46 | 184 | $1.29 |

| 1/8/2020 | $6.72 | 292 | $2.26 |

| 4/29/2020 | $10.09 | 406 | $3.37 |

| 9/1/2020 | $12.05 | 580 | $1.96 |

| 12/31/2020 | $15.16 | 659 | $3.11 |

| 4/12/2021 | $16.34 | 708 | $1.18 |

| 6/30/2021 | $17.52 | 853 | $1.18 |

| 9/30/2021 | $20.28 | 909 | $2.76 |

| 12/31/2021 | $24.40 | 978 | $4.12 |

| 3/31/2022 | $28.37 | 1,035 | $3.97 |

| 6/30/2022 | $30.49 | 1,097 | $2.12 |

| 9/30/2022 | $32.26 | 1,231 | $2.20 |

| 12/31/2022 | $34.09 | 1,274 | $1.40 |

| 3/31/2023 | $34.77 | 1,298 | $0.68 |

| 6/30/2023 | $36.10 | 1,330 | $1.33 |

| 9/30/2023 | $37.21 | 1,447 | $1.11 |

| 12/31/2023 | $37.62 | 1,461 | $0.41 |

More From Novogradac

Read more about this Opportunity Zone reporting update: QOFs Report $3.53 Billion Jump in 2023 Equity, Moving Total Beyond $37 Billion.