OZ 2.0 Enacted!

Opportunity Zone Tax Benefits: Unlimited Tax-Free Growth

Updated January 22, 2024

To encourage investment in economically distressed Opportunity Zones, there are multiple tax benefits available to U.S. taxpayers who reinvest eligible gains into Opportunity Zones via a Qualified Opportunity Fund.

The ability to achieve unlimited tax-free growth makes Opportunity Zones the greatest tax break ever created.

Free PDF Download

Get the full PDF version of this guide, Opportunity Zones Explained. Download it here.

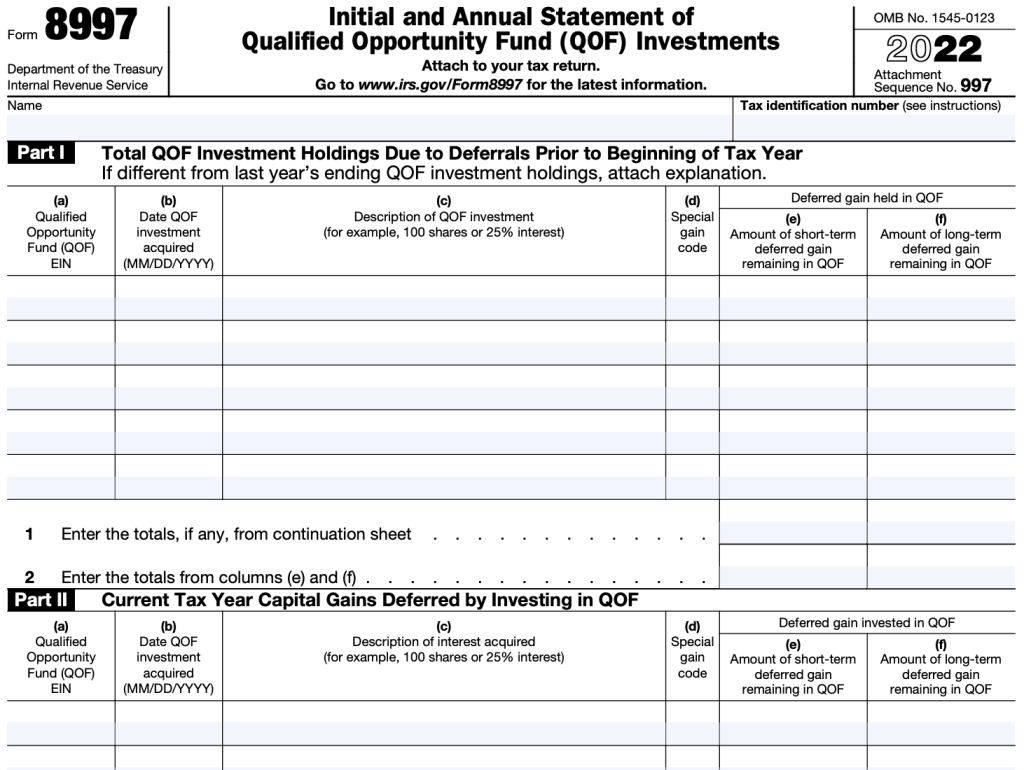

Powerful tax breaks are available to a taxpayer who reinvests an eligible gain into a Qualified Opportunity Fund within 180 days of triggering the gain. Eligible gains include both capital gains and qualified 1231 gains that would be recognized for federal income tax purposes before January 1, 2027.

The tax benefits include:

- Deferral of eligible gains until December 31, 2026.

- Reduction of eligible gains liability. (Note: this provision expired in two phases: on December 31, 2019 and December 31, 2021.)

- The big one: Elimination of tax on gains accrued in the Qualified Opportunity Fund after achieving a 10-year holding period.

- Plus, no depreciation recapture!

Benefit #1: Deferral of eligible gain recognition until December 31, 2026.

Any eligible gains reinvested into a Qualified Opportunity Fund within 180 days will be tax deferred until December 31, 2026, or the date on which the Qualified Opportunity Fund investment is sold, whichever is earlier.

This benefit essentially amounts to an interest-free loan from the federal government. A tax bill on a capital gain that would normally be due on April 15th of the year following the transaction date is now deferred until April 15, 2027.

(EXPIRED) Benefit #2: Reduction of eligible gains tax liability.

This benefit has now expired. But initially, eligible gains that were reinvested into Qualified Opportunity Funds by December 31, 2019 were eligible for a 15% basis step-up (essentially reducing the taxpayer’s 2026 gains bill by 15%.)

A 10% basis step-up was available for gains reinvested by December 31, 2021.

As of January 1, 2022, there is no longer such a basis step-up benefit for the reinvested gain. But the biggest benefit (#3, below) is still available.

Benefit #3: Unlimited tax-free growth! The 100% elimination of tax on capital gains from the sale of Qualified Opportunity Fund investments.

This is by far the biggest Opportunity Zone tax break, and the #1 reason why sophisticated investors are reinvesting capital gains in Qualified Opportunity Funds.

So long as a Qualified Opportunity Fund investment is held for at least 10 years, the basis of the investment will be adjusted to be equal to the fair market value of the investment on the date on which it is sold. In other words, there is zero capital gains tax due on any profits from the sale of an Opportunity Zone investment after a 10-year holding period.

Assuming a certain level of returns and tax bracket, an OZ investment can deliver 40 to 50 percent higher after-tax returns than a non-OZ investment. The table below compares the 10-year after-tax returns of a Qualified Opportunity Fund investment to a comparable non-OZ investment.

| Non-OZ Investment | Qualified Opportunity Fund | |

| Initial Gain | $1,000,000 | $1,000,000 |

| Tax on Gain | ($238,000) | Deferred |

| After-Tax Investable Amount | $762,000 | $1,000,000 |

| Compounded Annual Return | 8% | 8% |

| Value After 10 Years | $1,645,100 | $2,158,925 |

| Total Appreciation | $645,100 | $920,925 |

| Tax on Appreciation | ($153,534) | $0 |

| Capital Gains Tax Paid in 2027 | $0 | ($238,000) |

| Ending After-Tax Value | $1,491,466 | $1,920,925 |

Benefit #4: No depreciation recapture.

A fourth benefit (not even included in the table above) is the elimination of depreciation recapture. This can have a massive impact on the triple net returns of an investment that includes one or more depreciable assets. Typically when an asset is depreciated over time (a common accounting practice in real estate), the yearly depreciation is used to offset taxable income.

But when the asset is sold at a gain, the ordinary income tax rate is applied to the amount of the depreciation previously taken on the asset. In an Opportunity Zone investment, this depreciation recapture is 100% eliminated.

Table Of Contents: Opportunity Zones Explained

This page is part of our larger beginner’s guide to OZs: Opportunity Zones Explained. Follow the links below to read through the entire guide. Or, click here to download the full PDF version.

- Chapter 1: Opportunity Zones Explained — The basics of the OZ program.

- Chapter 2: Opportunity Zone Tax Benefits — How the OZ tax break works.

- Chapter 3: A Brief History Of Opportunity Zones — Policy background on the OZ legislation.

- Chapter 4: Where Opportunity Zones Are Located — Includes the map of Opportunity Zones.

- Chapter 5: Two Ways To Invest In OZs — Active vs. passive options for investing.

- Chapter 6: How To Invest In Opportunity Zone Funds — QOF investments for passive LP investors.

- Chapter 7: How To Start Your Own OZ Fund — How to create a self-managed OZ fund.

- Chapter 8: Opportunity Zones vs. 1031 Exchanges — Two popular tax deferral programs.

- Appendix: The Best Opportunity Zone Resources To Learn More — Recommended links.

About The Author

Jimmy Atkinson is a renowned Opportunity Zones industry leader. He founded OpportunityZones.com in 2018 as the leading OZ educational platform and investment marketplace. He is also founder of OZ Insiders, the premier private community for Opportunity Zone professionals and investors. And he hosts The Opportunity Zones Podcast.