OZ 2.0 Enacted!

What is IRS Form 8996, and who needs to file it?

IRS Form 8996 is used to certify an entity as a Qualified Opportunity Fund (QOF) and to demonstrate compliance with the Qualified Opportunity Zone (OZ) regulations. A QOF is an investment vehicle designed to invest in economically distressed areas known as Opportunity Zones. These funds provide significant tax benefits to investors who reinvest capital gains into them.

Form 8996 plays a crucial role in maintaining QOF status and ensuring that the fund meets the necessary compliance requirements. Below, we’ll explore who needs to file this form, how to complete it, and what to consider when maintaining QOF compliance.

Who Needs to File IRS Form 8996?

Any corporation or partnership that wants to be treated as a Qualified Opportunity Fund must file IRS Form 8996. This includes both new entities formed specifically as QOFs and existing entities that decide to convert to QOF status. Both professionally managed QOFs and self-directed QOFs need to file Form 8996.

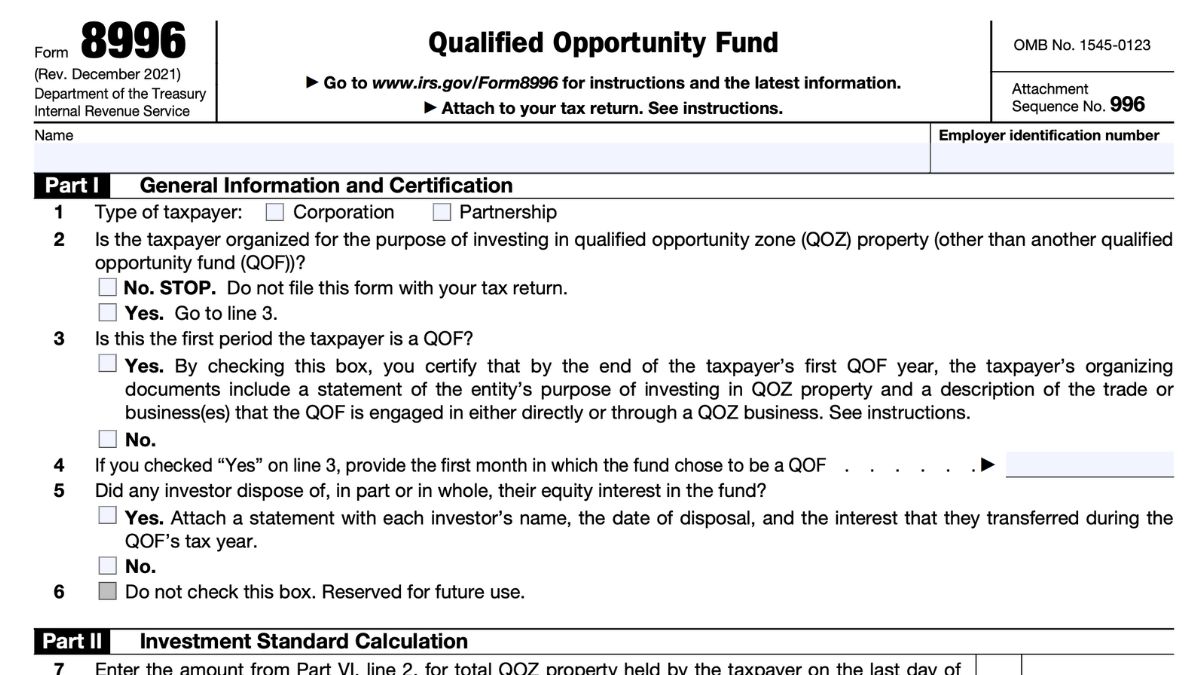

How to Complete IRS Form 8996

Filing IRS Form 8996 is a critical step for any entity seeking QOF status. Per IRS instructions, the form must be filed annually as part of the Qualified Opportunity Fund’s federal income tax return.

Part I: General Information

In this section, you will:

- Provide basic information about the entity, including name, address, and employer identification number (EIN).

- Indicate whether the filing year is the initial certification year.

- Specify whether the entity is organized as a corporation or partnership.

Part II: Qualified Opportunity Fund Investment Standard

The purpose of this section is to demonstrate that the QOF meets the 90% investment standard.

- The 90% investment standard requires that at least 90% of the QOF’s assets are invested in qualified Opportunity Zone property.

- This calculation is done twice a year: at the mid-year point and at the end of the tax year.

- You will need to calculate the average of the percentage of qualified property held on both testing dates.

- If the fund meets the standard, no penalty is assessed.

Part III: Penalty for Failing the 90% Investment Standard

If the QOF fails to meet the 90% investment standard, it must calculate and report a penalty.

- Multiply the shortfall by the IRS underpayment rate to determine the monthly penalty.

- The form requires a calculation of how much the QOF fell short and the amount of the resulting penalty.

- Include any reasonable cause explanation if applicable.

Part IV: Signature and Date

The authorized representative of the QOF must sign and date the form. This signature certifies that the information provided is accurate and that the entity agrees to meet the QOF requirements.

When to File IRS Form 8996

The form must be filed annually as part of the QOF’s federal income tax return.

- Due Date: The filing deadline coincides with the fund’s tax return deadline, including extensions.

- Frequency: File the form every year to maintain your QOF certification.

Related Form: IRS Form 8997

While Form 8996 is used by the Qualified Opportunity Fund (QOF) itself to certify and report compliance, Form 8997 is filed by individual investors or entities that have made investments in a QOF.

What is Form 8997?

Form 8997 is used to report the following:

- Initial investments in a QOF, plus annual reporting.

- Changes to the investment amount.

- Dispositions of QOF investments.

Who Needs to File Form 8997?

Any taxpayer who has made a qualifying investment in a QOF during the tax year must file Form 8997 with their personal or business tax return. This includes:

- Individuals who have invested capital gains into a QOF.

- Corporations or partnerships holding QOF investments.

How Form 8997 Relates to Form 8996

While Form 8996 reports the certification and compliance of the QOF itself, Form 8997 tracks the individual investor’s stake in the fund. Together, these forms ensure that both the fund and its investors are properly reporting their compliance with Opportunity Zone regulations.

Why Filing Form 8996 is Important

Maintaining QOF certification is essential to continue receiving the tax benefits associated with Opportunity Zone investments. Filing Form 8996 each year ensures that the IRS recognizes the fund’s status and that the fund remains compliant with the program’s requirements.

If the QOF fails to file the form or meet the 90% investment standard, it may lose its certification, resulting in penalties and a loss of the tax benefits for its investors.

Common Mistakes When Filing Form 8996

- Failing to File on Time: Since Form 8996 must be submitted as part of the entity’s tax return, missing the deadline can result in penalties.

- Incorrectly Calculating the 90% Investment Standard: Errors in calculating the average percentage of qualified OZ property can lead to penalties. Double-check calculations, especially if property valuations change between the testing dates.

- Failing to Include the Form with the Tax Return: Form 8996 must be attached to the QOF’s tax return. Forgetting to include it can result in non-compliance, even if the QOF meets the investment standard.

- Missing Signatures: The form must be signed by an authorized representative. Missing a signature can invalidate the submission.

- Not Reporting Penalties When Necessary: If the QOF fails the 90% investment standard, accurately reporting the penalty is essential.

- Confusing QOF and QOZB Filing Requirements: One of the most common mistakes is assuming that Qualified Opportunity Zone Businesses (QOZBs) must file Form 8996. This is incorrect. Only the QOF itself must file Form 8996 to certify and maintain its status. QOZBs do not file this form, as they are considered investments held by the QOF, not QOFs themselves.

How to Maintain QOF Compliance

To maintain compliance, follow these best practices:

- Monitor the 90% Investment Standard.

- Keep Detailed Records.

- Use the Working Capital Safe Harbor.

- Consult a Tax Professional.

Conclusion

IRS Form 8996 is essential for certifying and maintaining the status of a Qualified Opportunity Fund. Properly completing and filing the form each year ensures that the fund can continue to offer tax incentives to its investors. Including Form 8997 in the conversation is also important, as it addresses the investor’s reporting requirements.

Whether forming a self-directed QOF or investing in an established fund, staying diligent with Form 8996 and Form 8997 filings is crucial to maintaining compliance and securing long-term tax advantages.